Several applications, just like Cleo, are even more adaptable concerning the particular varieties of income they will permit, nevertheless all need a few form of steady income. A Genius registration tends to make it easy to be in a position to begin a good expense collection or get help together with complex economic problems. We All make use of several aspects to evaluate the money advance applications upon this listing. Just About All associate in buy to typically the overall expense associated with their particular solutions, simplicity of make use of, plus common applicability for each day funds management requires. One More on the internet banking application that offers a combination associated with early cash advancements plus early paycheck access is MoneyLion. Uncover the greatest cash advance programs that can provide an individual along with the particular funds plus features an individual require together with as few charges as possible.

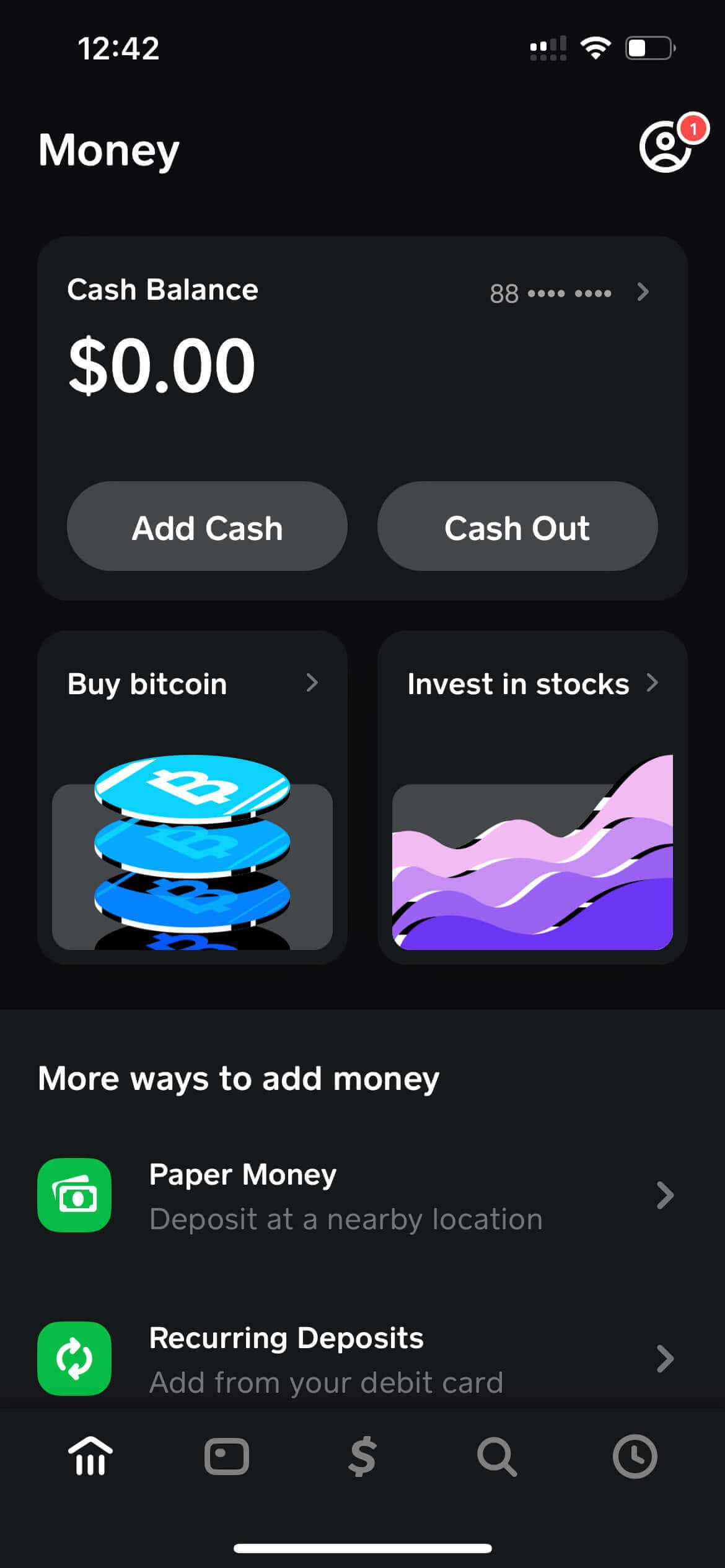

- An Individual just have to end upward being in a position to leap via several nets very first prior to a person withdraw cash to put to your current Cash Software stability.

- An Individual can obtain fractions associated with a coin (get started out with as tiny as $1), in inclusion to zero buying and selling costs use.

- The Two resources are obtainable with the particular free of charge variation associated with Brigit membership.

Follow The Funds

On Another Hand, this absence associated with credit reporting furthermore means that timely repayment won’t add to end upward being in a position to constructing or enhancing your credit background. In Buy To prevent unforeseen withdrawals, strategy your own budget accordingly in add-on to ensure of which typically the required funds will end upward being available inside your own bank account about typically the repayment time. Some funds apps may possibly provide overall flexibility in repayment phrases, thus check out your current alternatives and communicate with the particular program if a person anticipate challenges in conference the particular deadline day. Our Own staff investigated seventeen of typically the country’s most well-known funds advance programs, accumulating details upon each provider’s affordability, functions, customer knowledge in inclusion to popularity. All Of Us then scored each and every lender dependent upon typically the information points that make a difference the the greater part of to possible customers. Our Own selections with regard to typically the top 4 funds advance applications are usually EarnIn, Dave, Brigit and Present.

Is Usually Debt Combination Typically The Same As Bankruptcy?

On One Other Hand, they’re not a extensive solution in order to your own monetary woes. When you consistently have trouble making finishes fulfill, you require more as compared to merely a one-time money infusion. The extremely very first payroll advance application had been ActiveHours, which will be today Earnin. Away associated with the particular 354 evaluations supplied by simply GO2bank people upon Trustpilot, 93% provide the particular organization merely a single star score out there of five. Reviews about the particular Much Better Business Agency (BBB) site usually are no much better.

#4 – Moneylion: Borrow Up To Become Capable To $1,500 Together With No Attention Or Fees

Typically The upside to become able to this application is that will a person could earn factors to become able to borrow cash app counteract charges or enhance your current advances inside a selection of methods, including enjoying video games, scanning statements, plus using surveys. There are usually furthermore monetary tools accessible with Klover+ registration. Consumers can pick to end upwards being able to pay what they think is usually reasonable with respect to the support, starting from $8 to become capable to $16 each calendar month. On The Other Hand, right now there are simply no transaction fees or collection administration costs from Albert.

Keep In Mind to thoroughly evaluation typically the conditions, conditions, and charges regarding the software an individual select, and you’ll possess all the particular info a person require to help to make a good informed option and obtain typically the money you require. Signing upwards with consider to Current also gives an individual a Existing charge credit card, which usually you could make use of at hundreds of thousands associated with merchants or take away funds through nearly 40,1000 ATMs along with simply no fee. Signing Up with respect to Brigit In addition furthermore opens the ‘Auto Advance’ characteristic. This uses Brigit’s algorithm to be in a position to predict any time an individual may possibly work lower about money and automatically addresses a person to avoid a great undesirable overdraft.

Financial Loan Sum

In Case a person need the particular cash sooner as in contrast to that will, you may pay upwards in purchase to $4.99 with respect to a Super Speed deposit to your own charge card. There’s likewise an optionally available EarnIn Visa charge credit card of which enables with consider to upward to be in a position to $300 each day in fee-free money improvements. On your following payday, EarnIn will withdraw the particular advance sum plus any type of tip or Lightning Speed charge coming from your current connected looking at accounts. This Specific application helps consumers borrow funds immediately without large fees, offering these people speedy money advances when they will want them most.

When obtaining a loan via Funds Software Borrow, take note that this specific function offers an individual together with a short-term loan. This Specific cash may arrive via swiftly, yet Funds Application fees a flat 5% fee regarding the particular mortgage that will should end up being paid out again above 4 several weeks in purchase to avoid a just one.25% finance demand. And of course, some apps that allow an individual borrow cash right aside happily demand a person a tiny fortune with regard to the particular freedom.

Effect About Credit Report

Employ it with respect to quick cash in buy to offer together with a great unpredicted one-time expense. If you’re always at the trunk of, it’s time to be in a position to possibly generate added money or fasten your current seatbelt a step or two. Any Time an individual obtain your paycheck, all of which arrives away will be the $100 an individual in fact received — with out a good extra $15 or a whole lot more within interest. The apps make funds within numerous other ways, which include suggestions and month to month costs. Known As Albert Instant, it’s totally free to become able to make use of, nevertheless a person must have got a Guru subscription, which has a monthly fee.

Most Recent Concerns

It also gives quick money advances of which could aid a person keep afloat during tough occasions. While many Albert functions are usually available with respect to free, right now there is a payment regarding between $8 plus $16 for access in purchase to some associated with the particular app’s premium financial guidance. While Albert can’t manage all associated with your current finances for you, typically the software does provide useful equipment in add-on to ideas regarding wiser funds supervision.

Getting At an advance is straightforward inside typically the software – simply touch typically the Time Clock symbol in the higher still left corner, press “Money Advance”, in addition to evaluation the particular terms before placing your signature bank to upwards. Regrettably, not really all borrowers are qualified with regard to funds improvements. With Respect To instance, in case the particular app requires immediate downpayment for paychecks — plus an individual don’t have it — you might want to find a good software that will doesn’t demand primary deposit. Another chance is usually that will a person don’t fulfill minimum bank stability specifications or action, which often you could try out to become able to job about. Customers can obtain money advancements upwards to be able to $500 coming from the Vola software with zero credit score examine, interest charges or primary deposit required.

Best With Respect To All-in-one Monetary Supervision

When a person want even more money than most funds advance applications offer, PockBox is usually a fantastic approach to notice just how much an individual may borrow without having downloading it a half dozens of programs of which provide an individual funds. Also far better, several of the borrowing apps upon the listing are produced for individuals with poor credit – thus don’t stress in case your current credit rating will be lower than you’d just like. An Individual can be eligible along with no credit rating examine, and you’re not necessarily going in buy to acquire slammed together with individuals sky-high costs plus curiosity costs. Unlike other cash mortgage applications, Brigit reports your obligations to end up being able to the credit bureau in order to assist develop credit score. Brigit includes a totally free edition along with a pair features, yet to obtain the the majority of away of the particular service, you’ll need to become capable to pay $9.99 or $14.99 for each calendar month in buy to access a whole lot more characteristics.

- Depending upon your own program, typically the money ought to reach your own account upon the similar day time or up to a pair of business days.

- Cash advance applications usually are convenient in inclusion to generally low-cost yet have some downsides.

- A personal financial loan coming from a financial institution, credit rating union, or on the internet lender may possibly be a much better choice in case a person require to borrow a huge sum plus propagate payments above a longer period body.

- FinanceBuzz testimonials in inclusion to rates goods on a selection associated with quantitative in addition to qualitative conditions.

This option gives instant comfort plus helps prevent expensive payday loan apps. DailyPay plus Payactiv are portion of typically the gained wage entry market, which means they work together with your current company to become in a position to make component of your paycheck obtainable prior to payday. Cash advance applications such as the particular types listed here don’t function along with your current boss — they will basically provide an individual cash on their particular own before a person obtain paid out. Some Cash Application accounts holders could borrow funds directly coming from Money App via the Money Software Borrow characteristic.